Pitchbook has released their Q3 2022 global league tables, and Benchmark International remains an esteemed leader in the M&A world.

Benchmark is ranked the #1 sell-side-exclusive M&A firm globally. Other firms in the rankings focus on both the buy and sell sides or are accounting firms. However, Benchmark International is the only company ranked that focuses exclusively on the sell side.

Among our other prestigious rankings are the following:

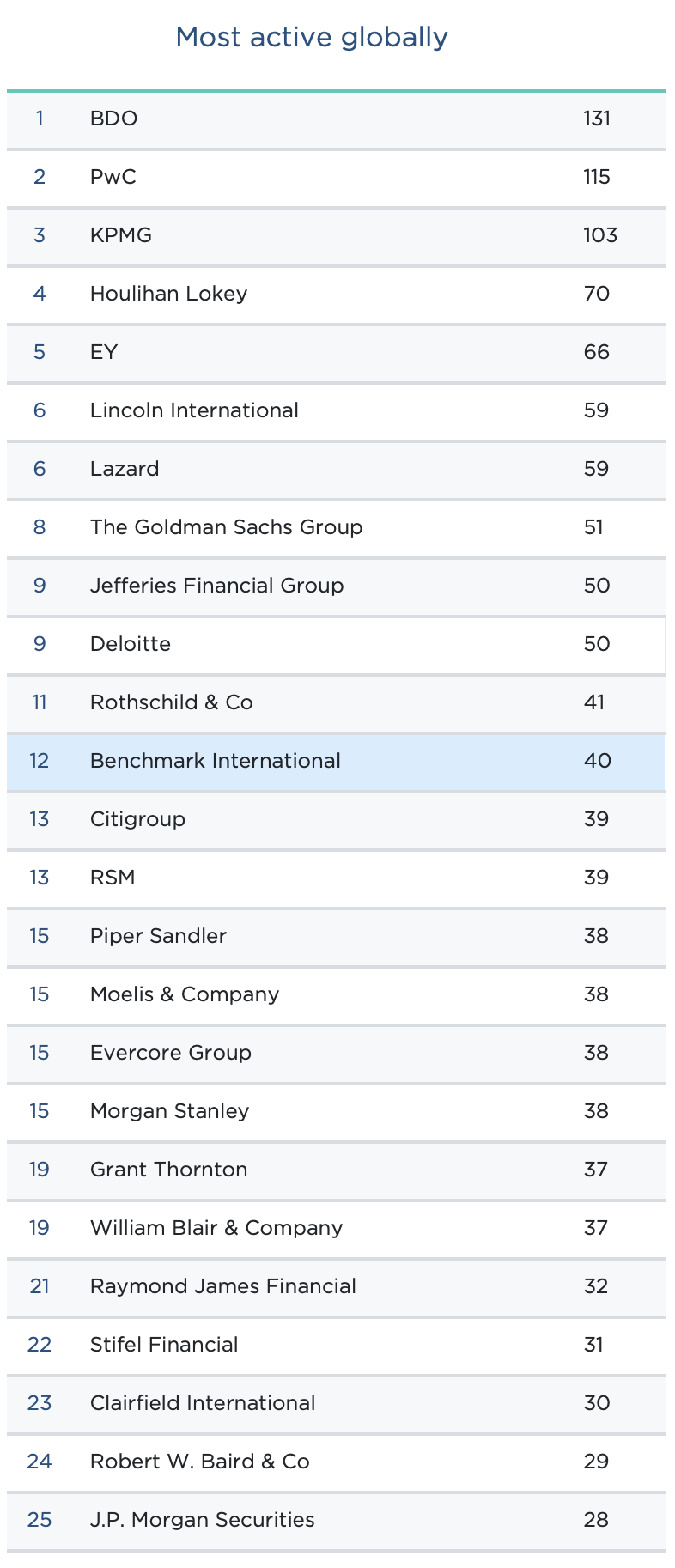

• 12th Most Active M&A Advisors Globally

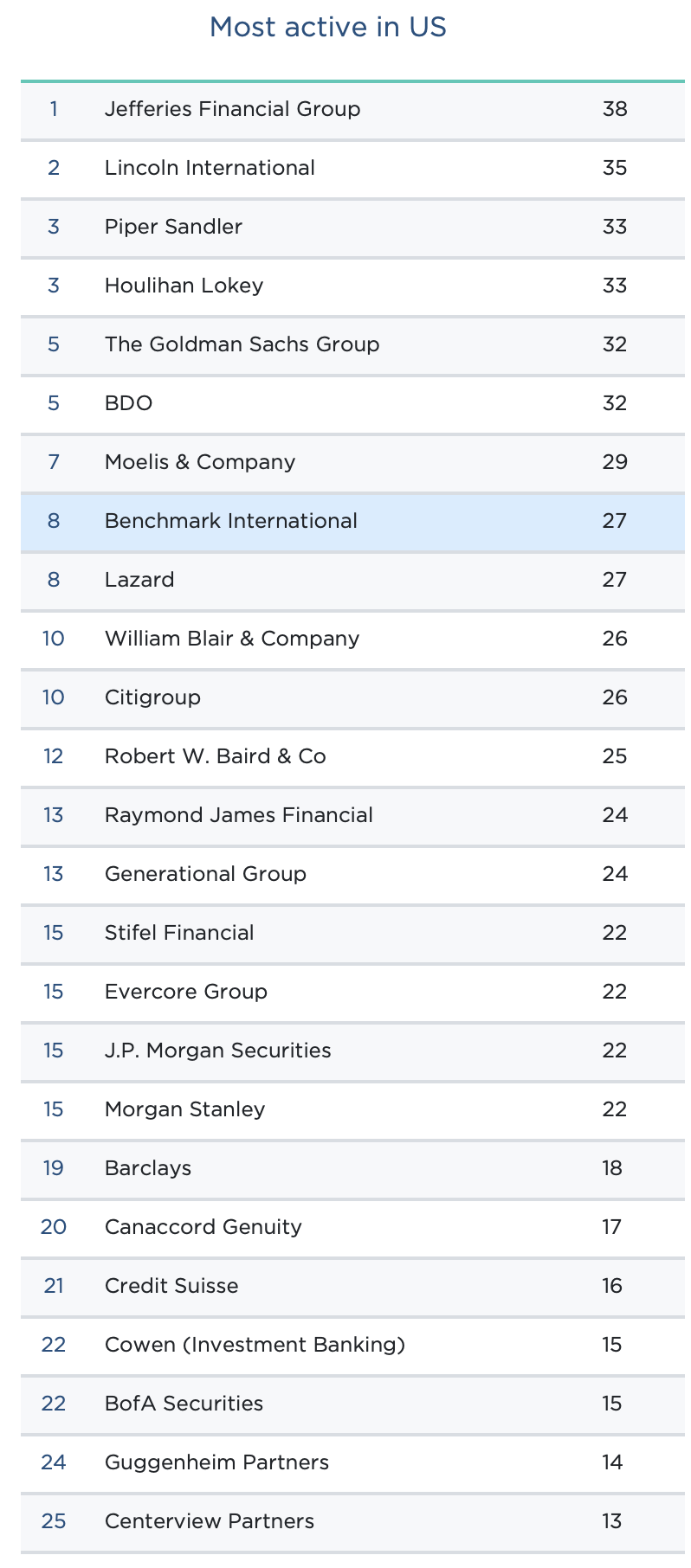

• 8th Most Active M&A Advisors in the US

• 24th Most Active M&A Advisors in the Rest of the World

• 10th Most Active M&A Advisors in UK & Ireland

• 17th Most Active Investment Bank in the US

• 22nd Most Active Advisors & Accountants (PE Deals Only) in the US

The updated rankings solidify Benchmark International's standing in the world as a trailblazer in the mergers and acquisitions community. The entire global and US tables are included below.

Steven Keane, Chairman of Benchmark International, said, "Benchmark International is different. We have the benefits of a global perspective, but we also treat each client as part of our family. Our team has first-hand experience owning and selling businesses and how personal that journey can be. That compassion—combined with our expertise—is why more and more business owners want to partner with us."

"We are proud to have earned our status among the top M&A firms in the world," said Gregory Jackson, CEO of Benchmark International. "Our teams work tirelessly on behalf of our clients, and every team member deserves recognition for always going the extra mile for our clients."

PitchBook is a leading financial data provider covering M&A, private equity, and venture capital deal activity. PitchBook's Global League Tables are a comprehensive report on private equity and venture capital activity worldwide for the year. They are compiled using the count of completed deals for the specified deal type, region, and other criteria. The listing only includes publicly disclosed transactions and those confirmed by PitchBook's primary

research team.

You can also view PitchBook’s profile of our company, which lists our services to companies, investment preferences, team, board members, and other information here.

Categories

Get These Insights Delivered Directly To Your Email

Explore our curated collection today and stay ahead of the curve in M&A.